January 16; Starting the most-exciting venture year yet 🧑🏻💻📈

Back in the midst of portfolio meetings and KPI measurements... this was my week ⭐️

Happy Sunday,

As it goes, it’s still Sunday somewhere in the world when you receive this, although I’m writing this early in the pre-dawn morning of Monday, from the Vitosha office in Sofia where I’ve spent long days last week, with plans to do exactly the same this week.

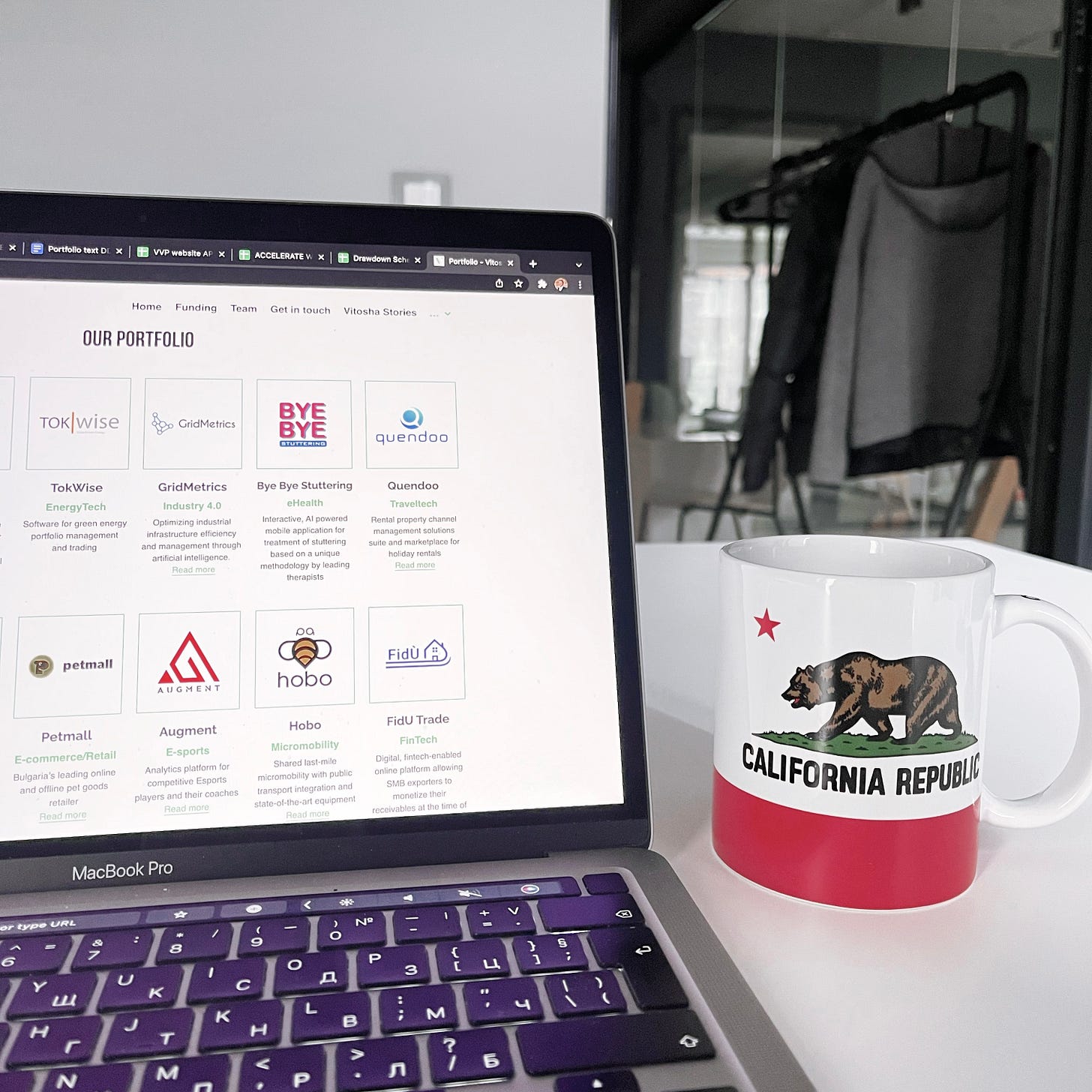

There is a big exciting reason for this: since the start of 2022, we’ve expanded our portfolio at Vitosha to 42 companies, which means that this year, the work of my partners and I will shift more from executing new investments (we still have 60 or so to do this year and next), to actual active portfolio management, working neck-deep with these 42 (and counting) companies we’ve invested in.

They always say venture capital is a slow industry, and I can’t but appreciate that wisdom: this summer it will be 5 years since we started actively working on the Vitosha fund, and here we are, four-and-half years later, shifting our focus finally to what investor work is all about: nurturing and growing the investment portfolio.

One of the things that goes with portfolio management is to actively showcase the companies, their progress, and where they’re headed, and you can expect lots of stories about the startups, and specifically the backgrounds of the founders, and the ingenuity that made us believe in them, here on Sunday Max, in the course of this year.

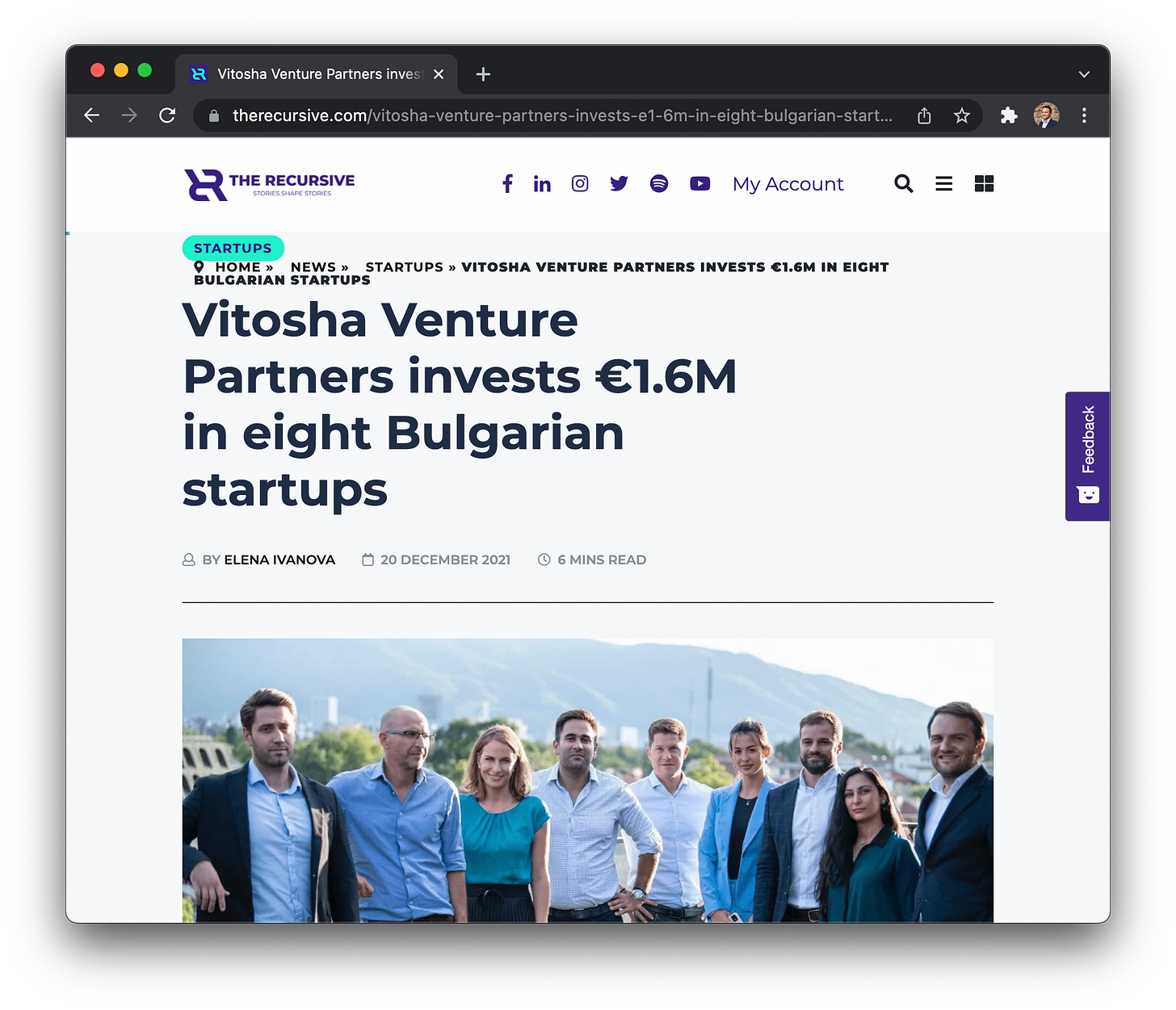

Over the holidays, we announced the first eight of these new investments, and in the course of the next few weeks we’ll be announcing another 17 that we finalized in the first week of 2022.

Within these first eight, the companies are a sweet mix of all the investment theses that we’re bullish on at Vitosha. From bets on globally-relevant cloud technologies, like mobile-app builder Dexycon or eye-measurement tool OptoExpert, to local-market plays, where Bulgaria and Southeastern Europe are playing catch-up on tendencies that are already proven elsewhere. Such investments are the utilities comparison tool for consumers Elca.bg and Agrovar, a platform that helps farmers switch to regenerative farming. And then finally, we also invested in sectors where Bulgaria has a proper global competitive advantage that goes beyond the availability of software engineers. Such are Noviotic, a company that exports probiotic starter cultures predominantly to Asia, and Black Sea Film, a video and digital media production house.

The really thrilling background to all of this is that we’re in the midst of an incredible technology and innovation renaissance in Europe. For the first time in modern history, technology investment returns in 2021 in Europe have outperformed Silicon Valley, and that’s a really big deal.

For me personally, ever since we started building Vitosha nearly five years ago, this development has always been on my radar, and I had a gut feeling that it’s a good bet to go broad and sector-agnostic on early-stage venture investments in Eastern Europe, as there’s both tremendous innovation potential with local creators and producers, as well as a big enough home market that can absorb a lot of much-overdue innovation.

With a fund that can diversify between stages, sectors, markets, and technologies across 100+ investments, it feels like we’re in a good position in the next few years to deliver a few wins. And much more importantly, to give opportunities to hundreds of ambitious entrepreneurs to work on their dreams and aspirations. All in all, it was more than worth the nearly five years of uphill struggles to get to this point!

And so if you’re in Sofia, you know where to find me on the working days this winter. Don’t be a stranger, let me know if you want to visit, and I’ll be happy to see you for a coffee and a chat.

Thanks for checking in today and talk to you next Sunday! 😇

If you enjoyed this Sunday Max update, feel free to subscribe to get it weekly in your inbox, if you haven’t yet: